Listen here:

http://www.thespainreport.com/5960/interview-daniel-lacalle-new-spanish-unemployment-data-spanish-energy-sector/

(The following was published in El Confidencial on 29/4/2014)

On Tuesday, the Spanish Labour Force Survey or the first quarter of 2014 was published. The official release of the Statistical Bureau (INE) states that “the total number of unemployed has fallen by 344,900 people in a year.”

The number of unemployed decreased by 2,300 people in the quarter and stands at 5,933,300.

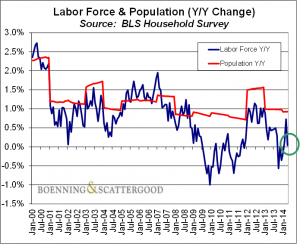

Unfortunately, the job participation fell by 184,600 people, although the decline is the lowest in a first quarter since 2008 .

The few positive data show fragility and weakness . These are insufficient. Taxes have to be cut. Political spending needs to be cut. The country needs to stop hindering job creation.

Labour participation fell by 195,800 people in the private sector, and increased by 11,100 and the public sector. Increasing public employment with more debt is not creating jobs. It enlarges the hole .

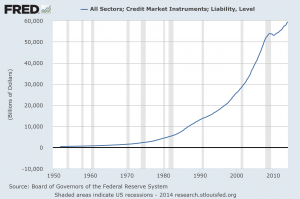

Taxes have to be cut. The fiscal effort in Spain remains one of the highest in the OECD. And it’s not a race to raise revenues, as I explained in the post ” Spending is the problem . ” The policy of sustaining GDP with bloated spending does not reduce unemployment. It’s urgent to cut taxes.

Spain has the potential to create millions of net jobs. It is expected that the country will create 650,000 new jobs between 2014 and 2015 – (I estimate about 800000 to 2016) – but it’s not enough.

Jobs will not come from a hypertrophied Administration that consumes nearly 45% of the country’s resources and where spending on public employment represents 11.9% of GDP, higher than the average of all the developed countries, which stands at 11.3%. Not to mention advisors (one billion euro per year) or employees of public companies.

Jobs are not going to come from large companies that already have an average of 20% more employees than its European peers (employees relative to turnover in the country, according to Bloomberg). Jobs will come from self-employment and SMEs.

To reduce unemployment Spain must:

To reduce unemployment Spain must:

– Encourage self-employment . Create businesses in 24 hours, as in many countries, not being one of the OECD countries where it is more expensive and slower to start a company. The time required to start a business in Spain is twice the average of the OECD. Creators of small businesses and startups can not see that the cost is unaffordable relative to the risk assumed.

– Encourage SMEs. We should not forget that they are the ones that create 70% of the added value of the country. Lower corporate taxes and Social Contributions to create jobs. The Spanish companies spend a total of 58.6% of their profits to pay taxes, according to World Bank data.

– Reduce self-employed fees. Self employed tax contributions have increased by 20%. This has to change now.

– Reduce taxes on businesses. New companies should not pay social security contributions and taxes until they have two years of profits, as in the UK. And drastically curtail bureaucratic obstacles and the extreme complexity of a country’s legislative system with seventeen regimes creating hundreds of rules each year. Change incentives: less foremen to “stop and control” and more facilitators.

– Reduce income tax to increase consumption. Yes. Save.Without savings, and later with consumption, the economy does not kickstart. Discouraging savings to keep an inflated GDP is a wrong and dangerous policy. The gross salary of a worker deducts 47.3% in taxes. Adding VAT, 67.4% of an average salary goes to the state.

– Cut political and superfluous spending, subsidies and bubble excesses , as I said in this post . Spain has increased government spending by 48% between 2004 and 2009 and only slightly reduced by 5% since 2010.

The solutions will not come from the same wasteful policies and interventionism that destroyed 3,000,000 jobs.

The Official Survey data shows the obvious: Not enough jobs are being created with a hypertrophied state. Data shows recovery but it is fragile and insufficient. Much more can be done.

We must lower taxes, and now.

Important Disclaimer: All of Daniel Lacalle’s views expressed in his books and this blog are strictly personal and should not be taken as buy or sell recommendations